Europe's Liquefied Natural Gas (LNG) Gamble

Exploring the Challenges and Risks in Meeting Europe's Winter Gas Demand

The European Union dealt a hammer blow to households and its industrial base, fuelling inflation as it made the expensive transition from Russian piped gas, which accounted for 45% of its total gas imports, to Liquefied Natural Gas (LNG). This shift was reinforced by measures such as restricting Russian banks' access to the SWIFT financial processing system, freezing foreign reserves, imposing sanctions, seizing energy assets, and implementing price caps. The sabotage of the Nord Stream 2 gas pipeline further accelerated the shift. Additionally, Russia's response, demanding payment for gas in Rubles, intensified the rush for LNG.

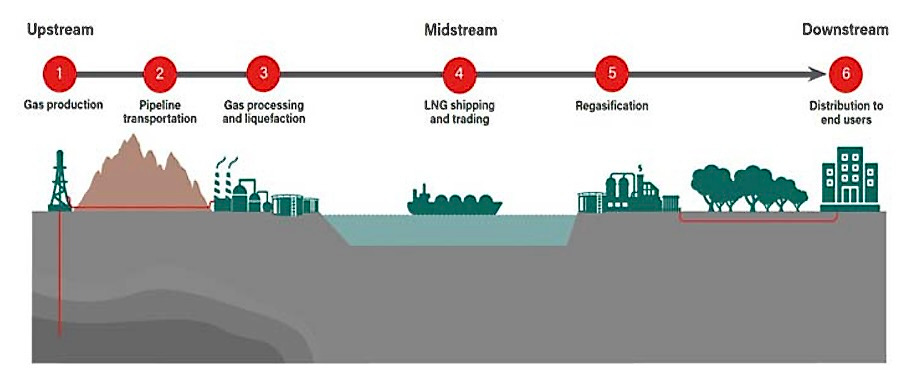

LNG is natural gas which has been cooled to approximately -160°C, changing its state from gas to liquid. This means it can be transported by ship, as the volume is around 600 times smaller than the gaseous state. Once at its destination, LNG is regasified and used in the same way as natural gas which has not been liquefied. LNG is multiples more expensive than piped gas, with costs ranging from 4 to 6 times higher. And capital intensive, requiring complex infrastructure.

Long before the onset of the Ukraine war, Russia likely viewed the EU's energy policy as unfriendly. The influential Third Energy Package of 2009 sought to replace long-term gas purchase contracts with spot and futures markets, affecting the predictability and affordability of gas costs. This hyper-financialization of Europe's gas market not only raised the risk of higher gas prices but also brought uncertainty to Russia's energy investments and planning.

The shift from a long-standing stable and predictable pricing environment, which had provided low gas prices to European consumers for decades, to a volatile and unpredictable pricing environment marked the onset of Europe's unfolding energy crisis.

Before the Ukraine war, Europe purchased about 155 billion cubic metres (bcm) of Russian piped gas, which made up about 45 per cent of its total gas imports. Last year, it purchased only 59 bcm, with the trend showing further reductions in 2023. Imported LNG, purchased on the gas spot market, played a pivotal role in filling the supply gap. Paradoxically, imports of Russian LNG have also soared. According to Montel's analysis — France, the Netherlands, Spain, and Belgium were the main importers of Russian LNG in 2022, making European Union countries the primary purchasers of Russia’s LNG supply. Additionally, gas imports via pipelines from Azerbaijan and Norway have experienced modest growth, rising from around 90 bcm to 101 bcm.

Europe's growing demand for LNG has led to a calls to end spot market purchases and instead agree long-term contracts to ensure reliable and cost-effective supply. However, this conflicts with the EU's commitment to achieving net-zero emissions, as critics argue that such contracts could hinder carbon reduction efforts. Interestingly, LNG production and transportation result in up to ten times more carbon emissions compared to pipeline gas, adding an ironic twist to the discussion.

Europe has managed to reduce its reliance on Russian pipeline gas by embracing imported LNG from the United States and Russia.

The United States (US) is Europe's primary supplier of LNG; in Britain, the US supplied half of the UK’s LNG in 2022. This is due to US LNG exporters having larger quantities of LNG available for spot market purchases compared to major exporters like Qatar who favour long-term contracts. Additionally, US exporters benefit from a significant cost advantage in terms of shipping. The transportation time from Cove Point, USA to Brunsbuttel port in Germany, which is Europe's largest gas consumer, is approximately half the time it takes from Qatar and only a third of the time it takes from Australia.

In 2022, the United States and the Middle East dominated LNG exports, while Japan surpassed China as the largest importer, potentially due to China's zero-Covid policies affecting its economy. Russian LNG exports increased by about 5%, while the United States faced a significant drop of over 40% due to an accident at its Texas LNG plant.

Europe's desperate effort to swap Russian pipeline gas for LNG is boomeranging. The tight global LNG market means Europe's frenzied buying is inflating prices. As European countries scour the world for LNG cargoes to replace Russian pipeline gas, they drive up costs for themselves and other importers.

Europe successfully managed the challenges of Winter 2022 with factors such as an exceptionally mild winter, high gas prices reducing demand, increased use of coal power plants, and delayed decommissioning of nuclear power plants. However, Winter 2023 will present tougher challenges.

Despite a significant decline from approximately 155 billion cubic metres (bcm) to 62 bcm in 2022, Russian pipeline gas supplies to Europe remained relatively close to normal levels during the first half of that year. This allowed Europe to replenish its gas storage reserves and secure alternative suppliers. The International Energy Agency (IEA) projects a further decline in Russian pipeline gas supply to around 25 bcm in 2023; the unpredictability of war could potentially reduce this further.

The global demand for natural gas is expected to surge, driven primarily by Asia’s robust expansion, the transition from coal to gas in China, and increasing industrialization in India and Asia.

LNG imports will also play a crucial role across Asia until 2030. Asia remains the largest market for LNG, receiving more than double the volume of Europe in 2022. Furthermore, Japan, China, and South Korea retained their positions as the three largest global importers.

Asia’s voracious demand for imported LNG could impact European gas supplies. In 2022, China experienced a substantial 21% decrease in net LNG imports, influenced by factors such as high spot LNG prices, an economic slowdown, and lockdown measures. China is gradually shifting toward negotiating more long-term contracts, and if LNG imports rebound to previous levels, it will limit the availability of LNG for the European market.

Europe's growing dependence on expensive US LNG suppliers has cost European taxpayers dearly, leading to higher energy prices and inflation whilst US LNG producer profits have surged. This has caused tensions between the US and Europe, with accusations of price gouging.

French President Emmanuel Macron specifically criticised the United States for what he perceived as a "double standard" in LNG pricing between Europe and the US domestic market.

The US Department of Energy responded to the criticism, asserting that the price markup and margin in the European market is not directly done by the US LNG companies themselves, but rather by European-based international oil companies and traders. Despite rising by a mere 5.5% in volumetric terms, the value of global LNG trade doubled in 2022 to an all-time high of USD 450 billion. Regardless of the tensions, Europe’s energy crisis has been a profits bonanza for both US and EU, oil and gas companies; Norway’s Equinor, Europe’s second largest gas supplier, reported a doubling of profits in 2022.

The availability of liquefied natural gas (LNG) in the global market is not expected to see a significant increase in 2023. This lack of supply poses a challenge for Europe, as Asia's potential competition for available LNG cargoes could further reduce the availability of LNG for European countries. Although Europe is racing to increase its LNG import capacity, as at January 2023 Germany had secured five Floating Storage Regasification Units (FSRU’s), and land based LNG plants are under construction.

The global demand for LNG carrier ships is also at a record high, with a 130% increase in 2022 compared to 2021. The surge in carrier ship demand, coupled with limited shipyard capacity in Korea until 2027, has led to steep price increases for new-build LNG vessels. Chinese players have significantly increased their presence in the LNG shipbuilding market, with Chinese yards receiving orders for 57 new LNG vessels in 2022, more than five times the number in 2021.

Whilst Europes carrier and import capacity can likely be sufficiently increased, the problem lies in securing future supply. Limited long-term supplies of LNG under contract mean that European buyers will need to continue paying a premium to attract cargoes away from Asian buyers. Currently, EU gas storage sites are 95% full, yet the risk of gas shortages in Europe including the UK during winter 2023 remains. The reduction in Russian pipeline gas supplies, combined with the uncertain availability of LNG due to increased Asian competition, creates a challenging scenario for Europe.

Looking beyond the short term, the global demand for natural gas is also projected to surge in the coming years, driven by Asia and other countries racing to industrialise and remilitarise. The rising gas demand from Asia is expected to be met primarily through LNG imports.

In this context, the Eastern Mediterranean region, including Israel, Palestine, Lebanon, Egypt, and Cyprus, holds increasing potential as a future major gas source for Europe. Exploration of their off-shore basins has led to the discovery of substantial gas resources, with the possibility of even greater volumes in the future. Constructing new pipeline connections with Europe in this politically intricate region, may tax the abilities of the the most talented negotiators. Therefore, companies with Eastern Mediterranean gas resources are likely to prioritise LNG options, including utilising existing LNG terminals in Egypt and potentially building new floating LNG plants.

In terms of gas demand in European countries, a predicted decline of 5% for 2023, would ease the pressure on LNG purchases. This decline is mainly driven by a decrease in gas burn in the power sector, as renewables expand and nuclear availability improves in France (imports of Russian nuclear energy-related goods and technology remain untouched by EU sanctions).

If Russian piped gas supplies cease and the global LNG balance tightens, a steeper demand reduction would be necessary in the European Union to stave off gas shortages…

as highlighted by the IEA. Europe’s Herculean efforts in switching from Russian pipeline gas to imported LNG has been purposeful, swift and costly. That said, the risk of gas shortages during winter 2023 remains, especially if Europe experiences adverse seasonal weather patterns. Securing reliable gas supplies in the medium term looks doable, if gas reserves in the Eastern Mediterranean, are aggressively exploited.

The glaring issue for Europe though, is the high cost it will now have to pay for its energy. This is already negatively impacting the competitiveness of material industries such as glass, chemicals, metals, fertiliser, pulp and paper, ceramics, and cement.

Adding to the gravity of the situation is the United States actively enticing European businesses to relocate across the Atlantic.

Compounding the issue is the intensifying economic competition from both China and an increasingly protectionist United States. European leaders are openly expressing their deep concerns about the growing risk of "deindustrialization" that poses a threat to manufacturing throughout the entire continent. With a revised GDP of -0.3% for the first quarter of 2023, Europes economic engine, Germany, has entered a technical recession.

The tempest of change is upon us, and it will leave no corner untouched." — Nikolai Gogol

Great work