Through Arctic Ice — China and Russia's Cold Ambitions

China and Russia are reshaping the Arctic's landscape, creating strategic depth — tapping into vast titanium and energy reserves and developing the Northern Sea Route and Polar Silk Road.

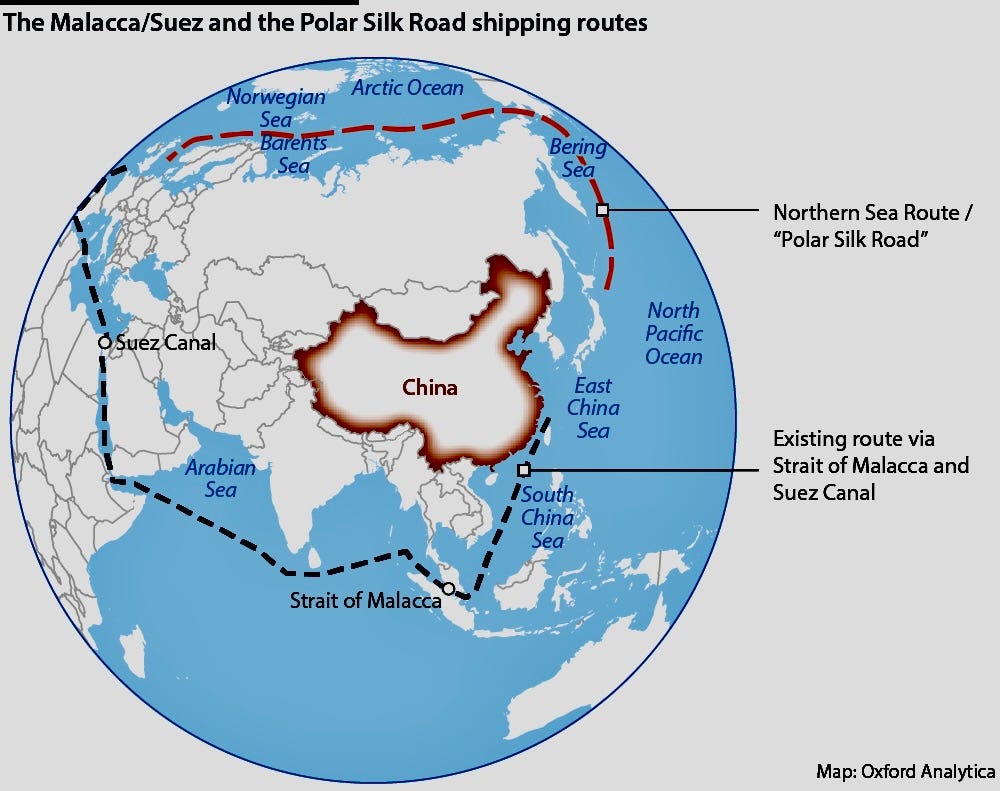

China and Russia’s development of the Arctic region, the Northern Sea Route and the Polar Silk Road continues unabated. Beyond receiving regular shipments of liquefied natural gas and crude oil from the region, Chinese and Russian companies are partnering to develop massive titanium and mineral deposits and preparing for a blockcade of the Malacca Straight.

The most commonly used geographical definition of the Artic is based on the northern polar circle. The Artic is essentially an ocean surrounded by continental states. The Norwegian Sea between Greenland and northern Europe links the Arctic Ocean to the Atlantic, and the Bering Strait between Asia and America connects the Arctic with the Pacific.

Covering 21 million square kilometres, the Arctic Circle is a treasure trove of minerals, metals, and fossil fuels. Notably, it holds an estimated 22 percent of the world's undiscovered oil and natural gas reserves. Additionally, rare earth minerals like neodymium (used in capacitors and electric motors) and terbium (essential for magnets and lasers) are abundant in the region. The combined value of these resources, found from Greenland's Kvanefjeld to Russia's Kola Peninsula to the Canadian Shield, is estimated to be in the trillions of dollars. However, tapping into these riches remains an expensive and specialised endeavour, requiring significant expertise and investment.

The Northern Sea Route (NSR) is a shipping lane along the Russian Arctic coast that connects the Atlantic and Pacific Oceans. It offers a shorter route for maritime trade between Asia and Europe. The NSR cuts the transit time from China to Europe by about 10 to 15 days compared to transit through the Suez Canal. As the Arctic ice continues to melt, the navigability of the NSR is expected to increase further.

Similarly, the Polar Silk Road, which is part of China's Belt and Road Initiative (BRI), will utilise the Northern Sea Route to boost trade links between China and Europe. This will strengthen China's economic connectivity with Europe reducing reliance on the Malacca Straight.

While the Suez Canal and Panama Canal remain vital global shipping routes, the shorter transit times offered by the NSR through the Arctic will have significant implications for international trade patterns. As the Arctic region becomes more accessible, more companies will utilise the NSR, reshaping the dynamics of global maritime commerce — this is happening today.

Titanium Supremacy

In 2021, a remarkable titanium deposit named Pizhemskoye was discovered in the remote Arctic Komi Republic region of Russia. This deposit holds a staggering 7 billion tons of ore, constituting more than 80% of Russia's total titanium reserves. Pizhemskoye's significance is evident as it ranks among the world's largest titanium deposits and is a central pillar of Moscow's Arctic investment strategy. As part of this strategy, an expanded Arctic deepwater Seaport at Indiga (located in Cape Rumyanichny, in the Nenets Autonomous Okrug (NAO), Russia) is being developed, serving as an additional export hub for transporting minerals through the Northern Sea Route.

Adding to Pizhemskoye's importance, Russian company Rustitan Group has recently secured a patent for an innovative titanium enrichment technology with major strategic implications. This groundbreaking technology enables Rustitan to process ore from the vast Pizhemskoye deposit, yielding vital titanium minerals like artificial rutile, pseudorutile, and ilmenite. These minerals are essential in numerous critical sectors, including aerospace, defence, automotive, and others that rely on high-performance lightweight alloys. See my previous post for a detailed breakdown of titanium production and the inevitable loss of Europes sole titanium sponge producer in Ukraine…

Artificial rutile, for instance, is a high-purity titanium dioxide that strengthens metals, plastics, and ceramics, making it instrumental in the development of lightweight aircraft and spacecraft. Pseudorutile can serve as a substitute for rutile in the production of titanium metals and pigments, while ilmenite plays a key role as feedstock for titanium dioxide pigment manufacturing.

The patented technology developed by Russian scientists, after research on Pizhemskoye's mineral composition, allows for closed-loop extraction (in a closed-loop extraction system, the extracted materials are carefully managed and recycled or reused within the same process).

Capitalising on Pizhemskoye's vast reserves, Russia will be able to position itself as the world’s largest titanium producer and exporter. Rustitan's breakthrough technology will also be instrumental in realising Russia's ambitious Arctic plans.

One of China's major engineering firms, China Communications Construction Company, recently signed an agreement with Russian Titanium Resources to develop the Pizhemskoye titanium mining project in northern Russia. The cooperation goes beyond just mining and includes related infrastructure like port expansions and railway connections to transport materials westward to the Northern Sea Route.

Bold investments in Arctic infrastructure pave the way for a thriving Northern Sea Route

The Russian Arctic has large deposits of coal, petroleum, and natural gas, as well as diamonds, gold, nickel, cobalt, copper, palladium, platinum, zinc, and rare earth metals. Today almost 60 percent of Russia’s exported commodities are produced from Siberia. Additional large deposits are expected to exist around the Lomonosov Ridge, on the seabed off Siberia.

Russia views the NSR as both an economic opportunity and manifestation of its strategic ambitions in the transforming Arctic. To realize this vision, Russia has invested over $90 billion through 2030 to develop the NSR's ports, navigation capabilities, and icebreaking fleets. Construction has started on the deep-water Indiga Seaport envisioned as a key hub along the NSR.

The new deep-water Seaport will includes extensive facilities for handling all types of cargo, including titanium, oil and LNG. With an annual capacity topping 60 million tons when fully built. The port will service massive 150-300,000 ton ships transiting between Asia and Europe. Connecting railroad infrastructure is also planned to enable smooth cargo transport to and from the remote Arctic location.

The Chinese company's role offers strategic benefits for both sides. For Russia, it brings investment to tap the region's resources and build out ports and railways linking Europe and Asia. For China, it secures access to vital titanium supplies, used extensively in aerospace, defense and other key industries where Beijing is seeking greater autarky.

For China, the world's largest titanium producer and exporter, securing access to Russian ore is a strategic priority. The announcement comes amid a flurry of other China-Russia Arctic partnerships, including deals for China to receive liquefied natural gas and crude oil shipments via the Northern Sea Route.

Russia aims to sign deals for cargo shipments as construction gets underway, underscoring Indiga's strategic role in opening up transportation of the country's Arctic resources. The vision is for Indiga to anchor Russia's presence along the Northern Sea Route and provide a gateway between the east and west.

China has also significantly increased its presence in the Arctic region with the introduction of its Snow Dragon II icebreaker, completing 62 transits through the Northern Sea Route in 2020. China plans to launch a supersized nuclear-powered icebreaker by 2025, enhancing its lift capabilities and facilitating the transportation of Russian liquefied natural gas.

As a permanent Arctic Council observer, China considers itself a 'near-Arctic' nation with broad interests. Its Polar Silk Road initiative and 2018 White Paper indicate its commitment to develop an icebreaker fleet.

Meanwhile, Russia is moving forward with its Leader-class nuclear icebreakers to establish year-round navigation along the Northern Sea Route by 2027. The lead Leader-class icebreaker will wield nearly double the propulsion of Russia's existing nuclear fleet. It utilizes two next-generation RITM-400 nuclear reactors to drive 60 megawatts of power to four massive propellers. With displacement of 69,700 tons, it will outweigh Russia's biggest icebreaker Arktika by over twofold.

Built to smash through ice up to four meters thick, the Leader-class will carve channels for oil and gas tankers across frigid Arctic seas. By comparison, the Arktika-class icebreakers can break ice up to only 2.3 meters thick.

Russia has ambitious plans to significantly increase the yearly transport volume of the Northern Sea Route (NSR) from 33 million tonnes in 2020 to 80 million tonnes by 2024. To provide context, the trade volume passing through the Malacca Strait annually is approximately 100 billion metric tons, accounting for around 25% of global trade. However, both Russia and China have shown their capability to turn small beginnings into substantial achievements across various economic sectors.

Currently, the majority of NSR trade revolves around liquid natural gas (LNG), with ice-class tankers increasingly transporting it to Asia. However, for exporting energy resources year-round, a fleet of icebreakers is essential, as only a small number of oil and gas tankers and coal ships possess the required hull strengthening for ice navigation. Unsuprisingly, Russia boasts the world's largest fleet of icebreakers, with approximately 40, including seven nuclear-powered vessels, and an additional three under construction.

Russian navy patrol icebreakers can also be deployed militarily. The Ivan Papanin can be equipped with eight Kalibr cruise missiles. The Ilya Muromez was the first new construction of a navy icebreaker in over 40 years. It, too, can be armed with cruise missiles. Three further navy patrol icebreakers (Project 21180M), have been commissioned.

Both Russia and China's progress in icebreaker technology and Arctic development hold significant implications for the region's geopolitics and global maritime trade.

Arctic Security

The Arctic region is yet another pressure point for geopolitical tension amongst the many that are in play at the moment. One significant area of contention revolves around sovereignty and territorial claims. Countries like Russia, Canada, Denmark (through Greenland), Norway, and the United States have been vying for control over Arctic territories, as demonstrated by their submissions to the United Nations Commission on the Limits of the Continental Shelf.

The UN Commission on the Limits of the Continental Shelf approved this year a significant portion of Russia's seabed claim in the Arctic Ocean, marking a milestone in the ongoing territorial disputes in the region. Russia had initially submitted its application in 2001, and after subsequent revisions, its claim has expanded to cover approximately 2.1 million square kilometres, extending along the Lomonosov Ridge beyond the North Pole to Greenland and Canada's 200-mile limit. However, both Denmark/Greenland and Canada have also filed claims, leading to overlapping areas of contention, including the crucial Lomonosov Ridge region.

While the Commission's confirmation is not the final decision as the claims from Denmark and Canada are yet to be processed, it does lend recognition to Russia's territorial aspirations from the highest international authority.

Securing the right to the continental shelf seabed grants the respective nation the authority to exploit all mineral and non-living materials within that area. This right does not extend to fishing.

Nevertheless, Russia is seen as the Arctic hegemon, due to its lion share of the area’s territory, resources, and population. Moscow’s recently enacted law regulating the navigation of foreign warships in the NSR has added to the complexity of the longstanding US-Russian dispute over the legal status of the Arctic region. However, the interpretations of the new law and its implications for Arctic security has sparked debate.

The new law explicitly distinguishes between commercial shipping and foreign warships, with the latter exempt from the NSR Rules of Navigation. This move aims to assert control over foreign military presence in the Arctic Ocean, reflecting Russia's growing concerns about increasing naval activities in the region. The law requires foreign warships seeking access to the internal waters of the NSR to apply for permission in advance, subject to specific restrictions, such as allowing only one warship at a time. This has raised concerns and speculation about the potential for Freedom of Navigation Operations (FONOPs) by the US in the region.

However, a closer examination suggests that the Act's significance may have been exaggerated. The new requirements apply solely to internal waters within the NSR, which comprise only a small portion of the entire route. Moreover, Russia has a history of requiring foreign warships to seek permission for entry into its internal waters, which adds context to the recent legislation.

While the Act does not resolve the long-standing dispute over the legal status of the NSR straits, it does provide clarity on the application of the NSR Rules of Navigation to foreign warships. The Arctic region's significance in geopolitical terms will only increase, with multiple countries vying for control and access to its valuable resources.

On 1 January 2021, a presidential decree upgraded Russia’s Northern Fleet to an autonomous military district, meaning the fleet has more autonomy including a nuclear strike capability. The Fleet is receiving new nuclear submarines, of the Borei class, with these submarines and their missiles, the Northern Fleet will possess the latest nuclear strategic weapons systems.

In addition, more than 50 ex-Soviet military outposts have been reopened, ten radar stations upgraded, and search and rescue stations established while border posts were revamped. The air force base on Alexandra Land island, Nagurskoye, has undergone expansion to accommodate modernised MiG-31 long-range interceptor fighter jets, anti-ship, and anti-aircraft missile batteries. Additionally, the navy is conducting trials for 13 new ships and equipping its aircraft and naval vessels with the newly designed Kinzhal hypersonic missiles.

The ongoing diplomatic conflict between the West and Russia has had a significant impact on the Arctic Council, previously a vital communication platform for Arctic powers. Under NATO pressure, seven members chose to withdraw their participation. However, it is noteworthy that each member of the Arctic Council has established military bases along the Arctic rim. This militarisation of the Arctic region escalated notably in 2007 when Russian scientists symbolically planted a titanium flag deep beneath the North Pole on the Arctic seabed. An illustration of this trend is Canada's ongoing construction of the Nanisivik Naval Facility on Baffin Island, Nunavut, with the goal of achieving full operational status by 2025.

China views the NSR and Polar Silk Road as a potential solution to mitigate its vulnerability to a maritime blockade of the Malacca Strait by the US. The Malacca Strait is a crucial route for China's overall trade. Much of China's exports and imports, including 80% of its oil imports, traverse through this narrow maritime passage which runs between the Malay Peninsula, which is part of Malaysia in the west, and the Indonesian island of Sumatra in the east.

The straight holds immense significance for global trade as a crucial waterway connecting the Indian Ocean and the Pacific Ocean, enabling a shorter route for ships traveling between Europe, the Middle East, and East Asia. This is particularly vital for China, heavily reliant on maritime trade, as it provides direct access to key markets in Europe, the Middle East, and Africa, supporting its economic lifeline. However, the strait's narrowness and its location near Indonesia and Malaysia makes it vulnerable to a blockade by the US.

The Polar Silk Road will also enable, naval formations being moved more quickly from the Pacific to the Atlantic, and submarines could be stationed in the shelter of the Arctic. There are opportunities here for shortening distances and reaction times in any Sino-American conflict.

China and Russia’s relationship with North Korea will also likely come into play. North Korea's Rajin Port, situated on its northeast coast, is the northernmost ice-free port in Asia and can therefore become a strategic port in the Northern Sea Route.

If Rajin is also connected to the Trans-Siberian Railway, it has the potential to become a significant logistics hub. Currently, there's a railway linking Russia and North Korea through the Tumen River crossing to reach Rajin. North Korea has the opportunity to integrate into the greater Eurasia economy.

The Northern Sea Route represents a significant opportunity for China to bolster its energy and trade security, providing a viable alternative to the Malacca Strait during any conflict with the US. Together with its BRI strategy, huge stockpiling of critical resources and military partnership with Russia, China is positioning itself with careful expedition, for potential, some believe inevitable, conflict with the US.

Great